If you’re struggling with a low credit score due to errors, past delinquencies, or negative marks on your credit report, you’re not alone, and Credit Saint may be a solution worth considering. As one of the most well-known names in the credit repair industry, Credit Saint offers personalized dispute services, credit monitoring, and a money-back guarantee designed to help clients rebuild their financial standing.

This review is for individuals who are looking for professional help to clean up their credit reports and improve their scores, whether you’re preparing for a loan application, trying to qualify for better rates, or simply aiming to regain control of your financial future.

In this 2025 Credit Saint review, we’ll cover everything you need to know: how the service works, its pricing and plan options, pros and cons, real customer feedback, and the best alternatives if you’re still weighing your options.

>> Credit Saint: Boost Your Credit Score >>

What Is Credit Saint?

Credit Saint is a New Jersey-based credit repair company that has been helping individuals improve their credit profiles since 2007. With over a decade of experience, the company has built a solid reputation for providing hands-on, customized credit repair services. It’s known for its transparent practices, strong customer support, and an A+ rating from the Better Business Bureau (BBB), a credibility marker that sets it apart in a crowded industry.

Credit Saint offers a range of credit repair solutions tailored to the severity of your credit issues. Its core services include disputing inaccurate or unverifiable negative items on your credit report, providing credit score analysis, and offering ongoing credit monitoring to help you track improvements. Depending on the plan you choose, Credit Saint can challenge hard inquiries, late payments, charge-offs, collections, bankruptcies, and more.

Importantly, Credit Saint operates in full compliance with the Fair Credit Reporting Act (FCRA), the federal law that governs how credit information is reported and disputed. This means the company only targets items that are legally eligible for removal and keeps its dispute practices within federal guidelines, helping you avoid potential legal issues while working to restore your credit.

Whether you’re facing serious credit damage or want to clean up a few lingering issues, Credit Saint offers structured, professional help with a track record of results.

>> Credit Saint: Credit Help With No Obligation >>

How Credit Saint Works

Credit Saint follows a structured, client-focused process to help improve your credit by identifying and challenging negative or inaccurate items on your credit report. Here’s how it works, step by step:

- Free Consultation and Credit Analysis: The process begins with a free consultation, where Credit Saint reviews your current credit standing and identifies potential issues. You’ll receive a personalized analysis based on your credit reports from the major bureaus, Equifax, Experian, and TransUnion.

- Plan Selection and Onboarding: After your initial consultation, you’ll choose one of Credit Saint’s three service levels, Credit Polish, Credit Remodel, or Clean Slate, based on how aggressive you want the dispute process to be. Once enrolled, you’ll gain access to your online dashboard to track progress, view updates, and communicate with your assigned credit team.

- Dispute Process: Credit Saint then begins the dispute process by identifying questionable or inaccurate items and formally challenging them with the credit bureaus. This may include disputes for late payments, charge-offs, collections, repossessions, and more. Each dispute round targets a set number of negative entries depending on your plan level.

- Credit Monitoring and Updates: Throughout the process, you’ll receive credit monitoring, ongoing support, and regular updates about your dispute status. You’ll also get insights into your credit behavior and recommendations to support better credit habits moving forward.

- Timeline for Results: Credit Saint operates on 45-day dispute cycles, meaning you can expect to see initial responses from credit bureaus within that window. While some clients begin seeing results in as little as one to two months, the full credit repair process may take 3 to 6 months or longer, depending on the complexity of your credit history.

Overall, Credit Saint offers a hands-on, transparent credit repair approach backed by personalized service, real-time tracking, and a 90-day money-back guarantee if no items are removed in the first cycle.

>> Act Now to Fix Your Credit With Credit Saint >>

Credit Saint Pricing & Plans

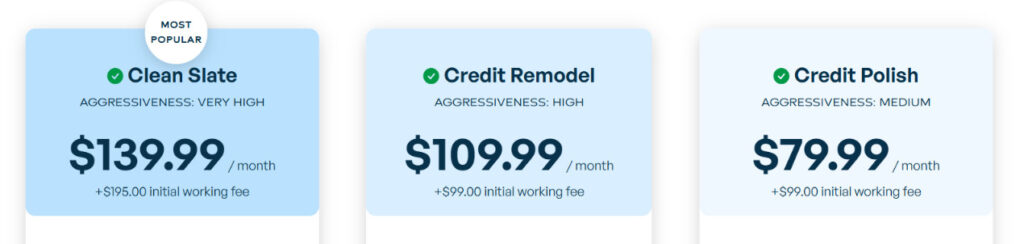

Credit Saint offers three service tiers, each designed to meet different credit repair needs. From basic disputes to aggressive interventions, here’s what you can expect from each plan:

1. Credit Polish

- Aggressiveness: Medium

- Monthly Fee: $79.99

- Initial Working Fee: $99.00

- Ideal For: First-time users or those with minor credit issues

Key Features:

- Moderate dispute volume

- Challenges late payments and soft inquiries

- Includes credit score tracking

- Online account access and basic educational tools

2. Credit Remodel

- Aggressiveness: High

- Monthly Fee: $109.99

- Initial Working Fee: $99.00

- Ideal For: Users with moderate credit damage

Key Features:

- More intensive disputes, including collections and charge-offs

- Public record dispute support

- Enhanced monitoring features

- Escalated tactics and better support access

3. Clean Slate (Most Comprehensive Plan)

- Aggressiveness: Very High

- Monthly Fee: $139.99

- Initial Working Fee: $195.00

- Ideal For: Severe credit issues or users needing full-service repair

Key Features:

- Unlimited dispute support

- Handles repossessions, bankruptcies, and more

- Cease & desist letters

- In-depth score analysis and personalized credit coaching

Refund Policy

Credit Saint offers a 90-day money-back guarantee. If no items are successfully removed from your credit report within the first 90 days, you can request a full refund of your monthly service fees.

>> See Results Fast With Credit Saint >>

Customer Reviews and Reputation

Before choosing a credit repair service, it’s important to know what real users are saying. Let’s take a closer look at Credit Saint’s reputation across major review platforms like Trustpilot, the Better Business Bureau (BBB), and Google.

Summary of User Feedback

- Trustpilot: Credit Saint has a mixed to positive presence here, with many users applauding its professionalism and effective results. However, the volume of reviews is relatively low compared to some competitors.

- BBB (Better Business Bureau): With an A+ rating, Credit Saint has earned high marks for transparency and responsiveness. There are both positive reviews and resolved complaints, suggesting an active effort to maintain customer satisfaction.

- Google Reviews: Customer experiences on Google echo similar themes, many are satisfied with improved credit scores, while others cite communication lags or billing misunderstandings.

Common Praise

- Noticeable score improvements within a few months

- Knowledgeable and friendly consultants

- Clear explanation of the dispute process

- Strong customer support during disputes and follow-ups

Common Complaints

- High upfront cost and recurring fees

- Lengthy dispute timelines, sometimes taking longer than expected

- Limited availability of services in certain states

- No mobile app, making account management less convenient for on-the-go users

How Credit Saint Compares in Customer Satisfaction

Compared to other credit repair services, Credit Saint ranks well in customer satisfaction, especially among those who value transparency and robust customer support. While it may not have the volume of reviews seen with larger national competitors like Lexington Law, the quality of feedback is strong. The 90-day money-back guarantee also sets it apart, providing peace of mind for new clients.

>> Improve Credit Fast With Credit Saint >>

Credit Saint vs. Top Alternatives

When choosing a credit repair company, it’s crucial to compare options side by side. Here’s how Credit Saint stacks up against leading competitors in 2025:

Credit Saint vs. Lexington Law

- Pricing: Credit Saint has setup fees ranging from $99 to $195, while Lexington Law has zero setup or cancellation fees. Both use a monthly subscription model

- Approach: Credit Saint is more aggressive with disputes; Lexington Law leans on legal tactics but has faced regulatory scrutiny

- Reputation: Credit Saint has a cleaner record with the BBB, while Lexington Law has had legal issues affecting its reputation

- Best for: Those who want transparency and strong customer service

- Not ideal for: Users seeking legal representation or those concerned with cost

Credit Saint vs. CreditRepair.com

- Pricing: CreditRepair.com is slightly more budget-friendly with flat-rate monthly fees

- Tools: CreditRepair.com offers better digital tools and a mobile app

- Support: Credit Saint edges ahead in personalized support and satisfaction guarantees

- Best for: Users wanting more hands-on customer support

- Not ideal for: Users needing mobile access and tech-friendly features

Credit Saint vs. The Credit Pros

- Pricing: The Credit Pros offer more affordable plans and tech perks like identity theft monitoring

- Features: Credit Saint focuses strictly on credit repair, while The Credit Pros include extras (e.g., budgeting tools)

- Service Style: Credit Saint is more straightforward and results-driven

- Best for: Those who want focused credit repair without distractions

- Not ideal for: Users who want bundled services like budgeting and credit monitoring

>> Trust Credit Saint to Repair Credit >>

Who Should Use Credit Saint?

Finding the right credit repair service comes down to your specific credit situation, budget, and expectations. Here’s a more in-depth look at who Credit Saint is ideal for, and who might want to explore other options.

Ideal For:

- With serious credit damage: If your report includes collections, charge-offs, or bankruptcies, Credit Saint’s aggressive tactics can help dispute and remove these items.

- People who want a strong dispute strategy: Their tiered plans escalate dispute efforts quickly, ideal if you want faster, more proactive results.

- Users who value support and guarantees: Known for responsive customer service and a 90-day money-back guarantee, Credit Saint appeals to those who want peace of mind.

- Anyone seeking legal clarity: Don’t want to navigate FCRA rules and draft letters? Credit Saint handles all the compliance-heavy work for you.

- Busy or overwhelmed individuals: If you’re short on time, they manage everything, from reviewing your report to handling disputes, so you don’t have to.

- Those prepping for big financial steps: Planning to apply for a loan or mortgage? Their service can help polish your credit before a major application.

Might Not Benefit:

- People with minor credit issues: A single late payment or high utilization might be fixable with free DIY methods like direct disputes or paying down balances.

- Budget-conscious users: The upfront cost is higher than some alternatives. If funds are tight, more affordable or DIY options may be better.

- Mobile-first users: There’s no mobile app or tech extras. If you want budgeting tools or on-the-go account access, other services may suit you better.

- DIY-savvy individuals: If you’re confident in writing dispute letters and navigating credit laws, free tools can get the job done at no cost.

- Those in unavailable states: Credit Saint doesn’t operate nationwide. Be sure to check if your state is covered before signing up.

11 Niche Experts

11 Niche Experts

100+ Product Reviews

100+ Product Reviews

50+ Tested Products

50+ Tested Products

At BestDaily, our mission is simple: to help you make confident, informed decisions about the products that impact your daily life. Whether you're searching for wellness essentials or lifestyle upgrades, we combine hands-on testing with expert analysis to highlight what truly works.

FAQ – Credit Saint Review 2025

Still, have questions about whether Credit Saint is the right credit repair service for you? Here are the most frequently asked questions to help you make an informed decision.

Is Credit Saint legit and FCRA Compliant?

Yes, Credit Saint is a legitimate credit repair company with over a decade of experience. It complies fully with the Fair Credit Reporting Act (FCRA), which regulates how credit bureaus and third parties must handle your credit information.

How Long Does It Take to See Results?

Most users begin seeing initial improvements within 45 to 90 days. However, credit repair is a process, and results can vary based on how many inaccurate items are being disputed and how quickly the credit bureaus respond.

What Types of Negative Items Can They Dispute?

Credit Saint can dispute a wide range of derogatory marks, including:

- Late payments

- Charge-offs

- Collections

- Bankruptcies

- Repossessions

- Foreclosures

- Inaccurate personal information

- Duplicate accounts

They evaluate your reports to identify disputable items and work in rounds to maximize removals.

Can I Cancel Anytime?

Absolutely. Credit Saint offers month-to-month service, which means you can cancel at any time without penalties or long-term contracts. Many users appreciate this flexibility if their credit improves faster than expected.

Does Credit Saint Offer a Refund if I’m Not Satisfied?

Yes. One of Credit Saint’s most attractive features is its 90-day money-back guarantee. If no items are removed from your credit report within the first 90 days, you’re eligible for a full refund, no questions asked.

Final Verdict: Is Credit Saint Worth It in 2025?

Credit Saint stands out for its aggressive dispute tactics, strong customer support, and 90-day money-back guarantee. While it lacks a mobile app and costs more upfront, it delivers real results for those with serious credit issues.

Compared to competitors, it offers better support and transparency, though not the lowest pricing. It’s ideal for users who value effectiveness over frills. If you’re ready to invest in professional credit repair, Credit Saint is a trustworthy option. Those with minimal issues may prefer free DIY tools.