If you’re struggling with a low credit score and finding it hard to qualify for loans, credit cards, or better interest rates, you’re not alone. Millions of Americans face credit challenges, and that’s where services like CreditRepair.com come in. Known as one of the more established names in the credit repair industry, CreditRepair.com claims to help individuals improve their credit profiles by disputing negative items and offering tools for long-term credit health.

In this review, we’ll inspect how CreditRepair.com works, what services they offer, how much they cost, and what real customers are saying. We’ll also explore the pros and cons of using the service and compare it to other popular credit repair options.

>> Fix Your Credit Score With CreditRepair.com >>

What Is CreditRepair.com?

CreditRepair.com is a credit repair service provider headquartered in Salt Lake City, Utah. Founded in 1997, the company specializes in assisting individuals to improve their credit profiles by identifying and disputing questionable negative items on their credit reports. Over the years, CreditRepair.com has facilitated the removal of over 8.8 million items from clients’ credit reports.

Mission and Value Proposition

The mission of CreditRepair.com is to empower individuals to achieve the credit scores they deserve and enjoy a lifestyle of greater opportunity. Beyond one-time credit repair, the company is dedicated to helping clients develop a healthier relationship with their credit, focusing on personalized strategies for long-term financial well-being.

Comparison to Other Credit Repair Services

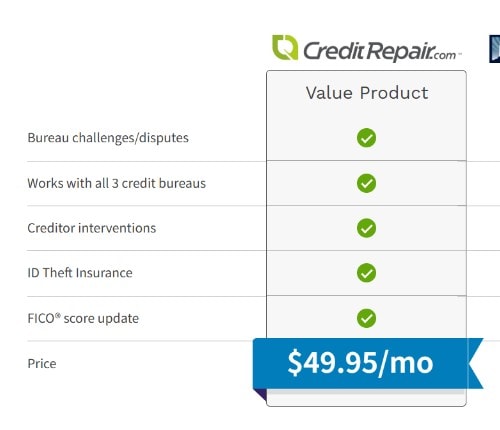

When compared to competitors like Credit Saint, CreditRepair.com offers a more affordable starting monthly price of $49.95. They offer a special promotion where a friend or family member can sign up and each receives 50% off their first payment.

CreditRepair.com has faced regulatory challenges; in 2023, the Consumer Financial Protection Bureau (CFPB) reached a settlement with the company over allegations of illegal practices, resulting in a $2.7 billion judgment and restrictions on certain marketing activities.

In summary, CreditRepair.com is a long-standing credit repair company with a mission to help individuals improve their credit health. While it offers cost-effective services, potential clients should weigh these benefits against the company’s regulatory history and compare features with other providers to make an informed decision.

>> Start Your Free Credit Evaluation Today! >>

How CreditRepair.com Works

If you’re wondering what it’s like to use CreditRepair.com, the process is relatively straightforward. The company guides you through credit evaluation, dispute handling, and long-term monitoring, all aimed at improving your credit profile.

Here’s a step-by-step breakdown of how it works:

1. Free Credit Evaluation

The process begins with a free online consultation, where CreditRepair.com reviews your credit reports and identifies negative or questionable items that may be hurting your score. This includes collections, charge-offs, late payments, and more. You’ll get a clear picture of where your credit stands and what might be addressed.

2. Dispute Process With Credit Bureaus

Once enrolled, CreditRepair.com sends dispute letters on your behalf to the three major credit bureaus (Experian, TransUnion, and Equifax). These disputes challenge inaccurate, outdated, or unverifiable items. The company also contacts creditors directly when necessary, aiming to improve your credit by getting harmful marks corrected or removed.

3. Ongoing Monitoring and Communication

Throughout the process, CreditRepair.com offers continuous credit monitoring to track changes in your credit reports. They notify you of any updates, progress, or new issues that arise. You’ll also receive regular credit score updates and progress reports so you can stay informed.

4. Technology & Tools

Customers gain access to a personalized online dashboard and mobile app, where they can:

- Track disputes in real-time

- View credit score improvements

- Receive alerts and recommendations

- Upload documents securely

This digital experience helps users stay engaged and in control of their credit journey.

>> Get Credit Help from Trusted Experts >>

CreditRepair.com Pricing & Service Tiers

When compared to competitors like Credit Saint, CreditRepair.com offers a more affordable starting monthly price of $49.95 offering bureau challenges, creditor interventions, ID theft insurance, FICO score updates, and Price.

Special Discounts

- Friends and Family: Occasionally, a 50% discount on the first work fee is available when signing up with a friend or family member.

>> Improve Your Credit With Proven Tools >>

CreditRepair.com Mobile App Review

For users who prefer to manage their credit repair progress on the go, the CreditRepair.com mobile app offers a convenient and user-friendly solution. Available for both iOS and Android, the app mirrors much of the desktop dashboard functionality while providing real-time access to your credit activity.

Key Features and Usability:

- Dashboard Access: Easily track disputes, monitor progress, and view your credit score changes from your phone.

- Alerts & Notifications: Receive push notifications for updates on disputes, score changes, and new credit activity, ensuring you stay informed without logging in manually.

- Document Uploads: Securely upload any required documentation directly through the app if CreditRepair.com requests additional info to support your dispute.

- Educational Tools: Access articles and tips related to credit improvement, helping users understand the process and make smarter financial choices.

User Experience:

Most users report that the app is intuitive and smooth, with a clean interface and simple navigation. You can easily jump between dispute statuses, credit summary reports, and support contact options. However, some reviewers have noted occasional glitches or slow loading times, especially during updates or maintenance windows.

Why It Matters:

The mobile app adds meaningful value for busy users who want to monitor their credit repair journey without being tied to a computer. It reinforces CreditRepair.com’s appeal as a tech-forward, accessible credit repair service.

>> Improve Your Credit With Proven Tools >>

Pros and Cons

Like any credit repair service, CreditRepair.com comes with both advantages and limitations. Here’s a quick breakdown to help you weigh whether it’s the right fit for your needs:

Pros

- User-friendly platform with intuitive online and mobile access

- Tailored dispute strategies designed to target specific credit report issues

- Credit monitoring and alerts included for ongoing oversight

- Established reputation with years of experience in the credit repair industry

Cons

- Higher monthly pricing compared to some budget-friendly alternatives

- No free trial or money-back guarantee, unlike some competitors

- Results may take time, depending on the complexity of your credit profile

>> Take Control of Your Credit With CreditRepair.com >>

Customer Reviews and Reputation

On Trustpilot, CreditRepair.com holds an impressive 4.5 out of 5-star rating, based on thousands of user reviews. Many customers praise the platform for its intuitive interface, timely updates, and educational tools that help them better understand and improve their credit. Several users also report noticeable improvements in their scores within a few months of enrollment.

However, the company currently has a C rating with the BBB, where user experiences are more mixed. While some clients commend the professionalism and thoroughness of the support team, others cite issues such as delayed results, billing concerns, or dissatisfaction with cancellation policies. Expectations and results often vary based on individual credit profiles and the complexity of the items being disputed.

From a user experience standpoint, the mobile app and online dashboard are well-reviewed for ease of navigation and real-time dispute tracking, though some users have reported minor glitches.

Overall, CreditRepair.com is praised for its long-standing presence, transparent tools, and credit monitoring features, but prospective users should weigh the customer service feedback and pricing structure before committing.

>> See What’s Hurting Your Credit Score >>

CreditRepair.com Alternatives

When comparing CreditRepair.com to other major players in the credit repair industry, several alternatives stand out, each offering unique strengths depending on your financial needs and credit repair goals.

Credit Saint

Credit Saint is a top competitor, known for its aggressive dispute process and excellent customer service. Unlike CreditRepair.com, Credit Saint offers a 90-day money-back guarantee, giving clients added peace of mind if no results are seen early on. Its tiered plans allow for more disputes per cycle, making it a better option for those with significant credit issues who want faster, more assertive intervention.

>> Take Control of Your Credit Now! >>

Lexington Law

Lexington Law offers a more legally focused approach to credit repair, with attorneys and paralegals involved. This makes it ideal for consumers facing complex credit challenges who might benefit from legally crafted dispute letters. While both Lexington Law and CreditRepair.com have similar core services, Lexington Law’s legal credibility can provide an extra layer of reassurance for some users, though it tends to be slightly more expensive for premium plans.

>> Take Control of Your Credit Now! >>

The Credit Pros

The Credit Pros takes a broader approach by bundling credit repair with financial wellness tools. Besides disputes, customers get access to identity theft protection, budgeting apps, and credit monitoring. This makes The Credit Pros a better fit for those who want to improve their overall financial habits while repairing their credit. However, for users focused solely on credit disputes, these added features may feel unnecessary or overwhelming.

>> Take Control of Your Credit Now! >>

Who Should Use CreditRepair.com?

CreditRepair.com is best suited for individuals who need ongoing support in improving their credit. If your credit report contains multiple errors, outdated negative items, or complex issues like collections and charge-offs, this service offers a structured approach to dispute management. It’s also ideal for those who value credit monitoring tools, alerts, and a user-friendly dashboard to track their credit progress in real-time.

This platform is a solid fit for anyone seeking a hands-off, professional solution with consistent updates and guidance, not just one-time fixes.

However, if you prefer a DIY approach, have minimal issues on your credit report, or are looking for a one-time credit cleanup, you may not need the full scope of CreditRepair.com’s monthly service. In those cases, free dispute tools or budget-friendly alternatives might be more appropriate.

11 Niche Experts

11 Niche Experts

100+ Product Reviews

100+ Product Reviews

50+ Tested Products

50+ Tested Products

At BestDaily, our mission is simple: to help you make confident, informed decisions about the products that impact your daily life. Whether you're searching for wellness essentials or lifestyle upgrades, we combine hands-on testing with expert analysis to highlight what truly works.

FAQ – CreditRepair.com Review

If you’re considering signing up with CreditRepair.com, you likely have a few questions about its legitimacy, effectiveness, and policies. Below are answers to the most common questions to help you make an informed decision:

Is CreditRepair.com Legit & FCRA-Compliant?

Yes, CreditRepair.com is a legitimate credit repair company and operates in compliance with the Fair Credit Reporting Act (FCRA). This means they only dispute items that are inaccurate, outdated, or unverifiable and use legal channels to challenge questionable marks on your credit report.

How Long Does It Take to See Credit Improvement?

Results vary depending on your credit history and the number of negative items on your report. Some users see improvements in as little as 30 to 60 days, but 3 to 6 months is a more common timeframe for meaningful changes.

Can I Cancel the Service Anytime?

Yes, CreditRepair.com allows you to cancel at any time without penalty. Since the service is month-to-month, you’re not locked into a long-term contract. Just be sure to contact customer service before your next billing cycle.

Does CreditRepair.com Guarantee Results?

No, CreditRepair.com doesn’t guarantee specific outcomes, as credit repair depends on individual credit reports and the responses from credit bureaus. However, they do offer a transparent process and regular updates, and many users report improvements over time.

Conclusion: Is CreditRepair.com Worth It?

CreditRepair.com is a reliable choice for users seeking hands-off, ongoing credit repair support with useful tools like monitoring and score tracking. It stands out for its structured process and ease of use, though its monthly fees are higher than some competitors.

If your credit issues are complex or long-standing, the value it offers may justify the cost. However, budget-minded users or those with minor errors might find better value in DIY or lower-cost services. Overall, it’s a strong option for steady, professional credit improvement.